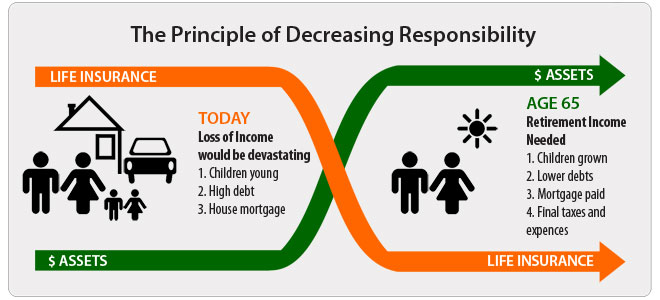

The principle of decreasing responsibility is a financial planning concept that states that an individual with dependents, such as a spouse and/or children, has financial responsibilities that life insurance can help meet in the event of their death. In addition, these responsibilities can only be met with available assets, with any shortfall being covered by life insurance benefits.

For example, if a man has a wife and two children, calculations can be made to evaluate the capital and income needs of a surviving family should he predecease his loved ones. These responsibilities may include paying consumer debts, mortgages, funding children’s education, and replacing lost income.

The early family years. The principle indicates that there will be a temporary shortfall of funds needed as the individual builds up their estate’s value, retirement savings, emergency funds, and educational funds, and continues to work and earn an income during the early family years. However, the ultimate goal is to achieve financial independence.

The 50-plus years. The principle also holds that there may be long-term needs for potential final expenses and/or capital gains taxes due upon the estate’s final distribution. The more successful one is, the higher the potential for final taxes due on a cottage, second residence, a business sale or succession, with the risk of probate and/or estate probate/administration taxes (EAT).

An advisor can help you determine how much temporary life insurance you will need, and balance it with the projected need for some permanent life insurance for estate planning purposes.

Do not assume that having investments on hand that produce an income, or that can be converted to cash, is preferable to having life insurance with a monthly premium. Life insurance can ultimately provide a tax-free death benefit at precisely the right time, delivering capital to dependents who have multiple needs.

Regardless of any life insurance coverage, an insured person must take responsibility to plan to become financially independent.